Bombardier, continuing to meet financial objectives in its turnaround plan, has upped its goals for 2025, now targeting more than $9 billion in revenues by 2025 as it plans to deliver 150 aircraft annually by that time frame. The $9 billion marks an improvement from the $7.5 billion goal laid out in 2021, when Bombardier became a pure-play business aviation company, and the $6.9 billion brought in 2022. Increased deliveries would be a ramp-up from 120 in 2022 and the anticipated 138 in 2023.

Along with revenues, Bombardier has set more aggressive profitability targets, and is anticipating an adjusted EBITDA of more than $1.625 billion, compared with the original goal of $1.5 billion.

“In 2021, we laid the foundation for a stronger, more resilient, and predictable Bombardier by 2025. Halfway down the road, we can say we are delivering on that promise,” said Bombardier president and CEO Éric Martel. “All of Bombardier’s strategic priorities are on track or ahead of plan. We are therefore proud to announce today that we are confidently raising the bar.”

Contributing to the improved results are returns on its long-term plans to expand its aftermarket revenues, and Bombardier executives said during an Investor Day on Thursday that they are well on their way to achieving a $2 billion annual contribution from that business by 2025, a 50 percent jump from 2020 and up from $1.5 billion in 2022. Propelling this has been a dramatic expansion of its aftermarket footprint that has included the opening of new or expanded centers in Miami, Melbourne, London, and Singapore, among other activities.

Also contributing to the improved revenues is growth beginning in its certified preowned program and defense business. However, Martel noted that Bombardier expects those businesses to significantly ramp up in the 2025 to 2030 timeframe including the possibility for defense bringing in $1 billion by the end of the decade. As for certified preowned, Bombardier sees about 460 of its jets turnover in the used market each year, providing a solid growth opportunity.

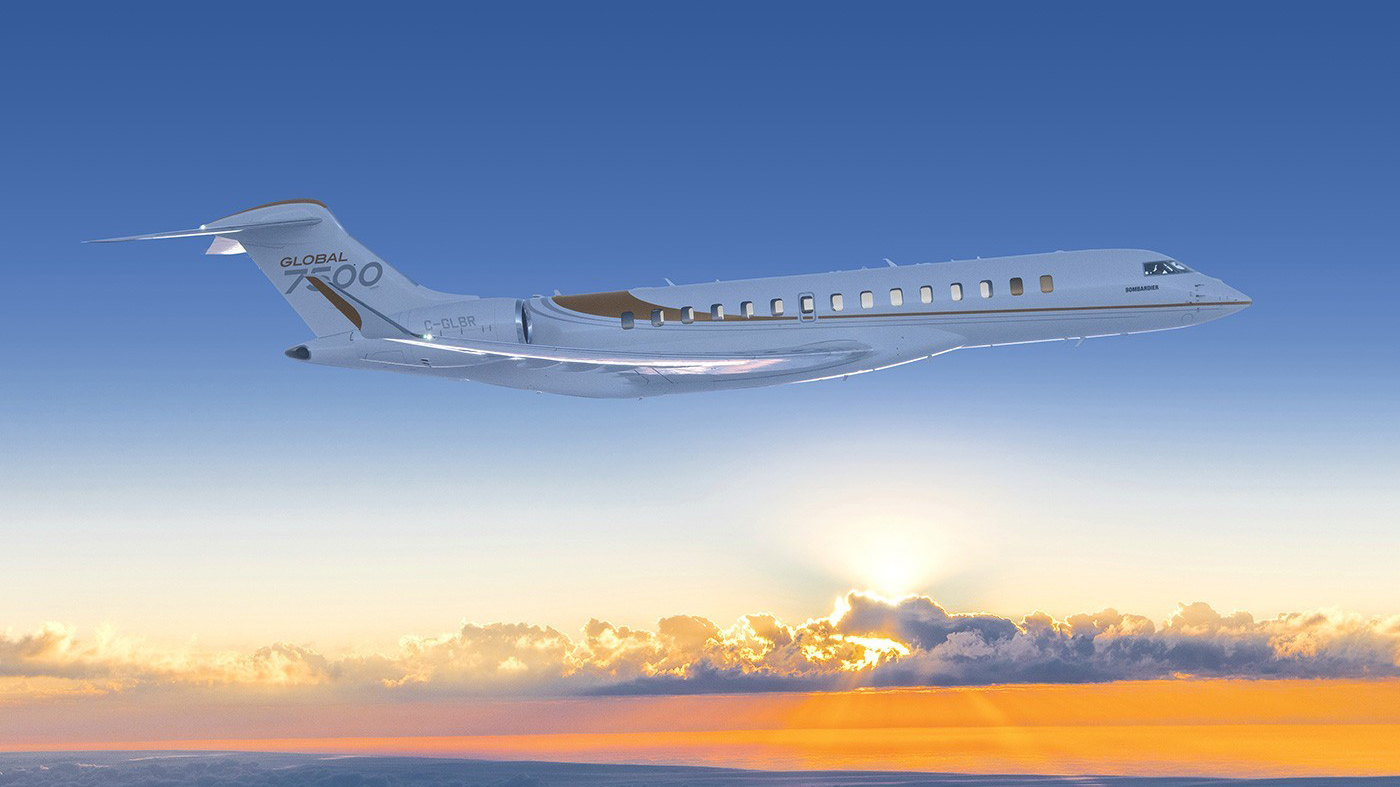

As for improved profitability, Martel perceives the Global 7500 as being a key contributor over the next several years but said that the company is anticipating stronger returns on all of its aircraft.

Another key target that Bombardier has upped is free cash flow, anticipating it to reach $900 million by 2025. This would provide “capital allocation optionality,” accordinfg to executive v-p and CFO Bart Demosky, including options for a new aircraft, mergers, and acquisition activity—further easing of its debt burden or returns to the shareholder.

This gives Bombardier more flexibility, which has reined in research and development spending in the past several years.

“We’re going to have the same discipline,” Martel said of the additional free cash flow. “We’re going to put all the options on the table…and look at every dollar we have.” Decisions will be made from a purely financial standpoint on what is best for the shareholder and for the long-term growth of the company.

Enabling this is a 45 percent reduction in its gross debt to $5.6 billion in 2022 and a dramatic drop in its net leverage ratio (principal debt outstanding less unrestricted cash) from 41.5 times in 2020 to 4.6 times last year. This reduction has led to improved credit ratings, lowering the cost of borrowing, as well as reduced interest payments.

Also speaking to reporters on Thursday, Martel called Investor Day an “important milestone,” noting the skeptics of its original plan and expressing confidence in the company’s trajectory. He did acknowledge economic and supply-chain uncertainties but believes that he’s comfortable with the short-term in light of its financial progress. “We are well equipped because we made the company more solid.”

Source AIN Online

Cessna Citation V

Cessna Citation V